Is Your Health Incentive Program Compliant?

A health and wellness incentive program can significantly contribute to a healthier and more productive workplace. When designing a quality health and wellness incentive program, and thinking about utilizing rewards and incentives as part of your program, it is essential to ensure that your program is compliant with all legal requirements applicable to your particular type of health and wellness incentive program.

Wellness Program Types

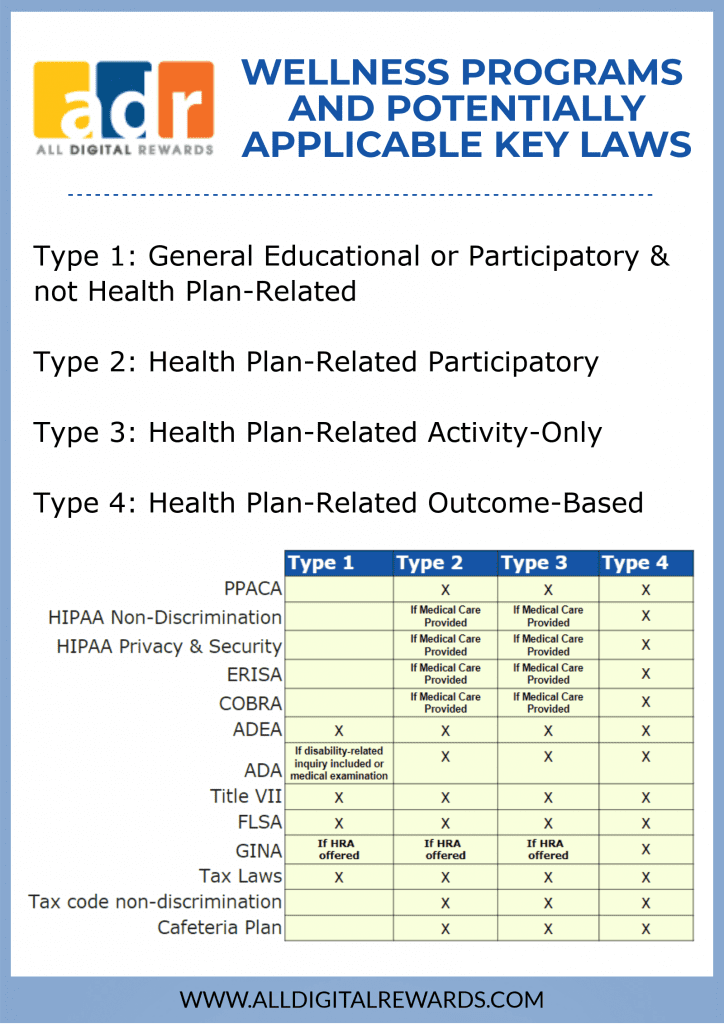

There are four main types of health and wellness programs we are going to review in this article. Each type of health and wellness program has its unique features and various applicable laws. The four program types we will be considering include:

- Type 1: General Educational or Participatory & not Health Plan-Related

- Type 2: Health Plan-Related Participatory Programs

- Type 3: Health Plan-Related Activity-Only Programs-Based Programs

- Type 4: Health Plan-Related Outcome-Based Programs

Type 1: General Educational or Participatory and not Health Plan-Related

General educational or informational programs are designed in such a way as to provide general health education and information to employees and, on occasion, their families. These voluntary programs make educational information available to employees without requiring the employee to access the information or engage in an activity. These general education programs are not individually tailored to employees, and they do not provide any medical care.

Participatory programs that are not health plan-related are created with the intent of encouraging employees and occasionally family members to make healthy lifestyle choices, but they do more than merely provide information. They will also include a type of health-related activity for the participants. These activities are purely voluntary and do not have a reward, or they have a reward that is in no way tied to a health plan. These types of programs are subject to far fewer federal employment and benefits laws than many other types of health and wellness plans.

Some examples of educational and information programs include:

- Posters in the workplace with tips on avoiding getting sick

- Company newsletters related to the benefits of exercise or making healthier food choices

- Educational lunch sessions discussing health topics

- Having healthy vending machine snacks or healthy cafeteria food

A few examples of reward s for participatory programs could include:

- $20 gift card

- Reward merchandise

- Reward cards with digital downloads

- Special recognition

Type 2: Health Plan-Related Participatory Programs

Type 2 programs are participatory as they require employees’ participation in health-related activities. However, they reward the participation, rather than the results of the employees’ participation. These are health plan-related because they must be limited to the employees that are enrolled in their employer’s health plan. There are many federal benefits and employment laws that apply to these particular type of programs. Generally, programs that involve the provision of health care tend to have more applicable requirements.

Some examples of participatory programs that do not have a reward are:

- Fitness and exercise-related incentives such as exercise bikes or treadmills made available for employees to use during their work breaks or lunches.

- A voluntary lunchtime exercise program that employees may elect to participate.

- Employee health-related coaching, eating and exercise plans provided by non-healthcare providers.

A few examples of participatory programs that include a reward incentive are:

- Fitness activity tracker

- A hat or shirt was given as a reward for attending health-related classes or seminars

- A $15 reward gift card for an employee who attends a smoking cessation class

- Reimbursing some of the cost for membership at a health club or gym, regardless of the employee’s eligibility for the company’s health plan.

- A weight loss contest with a $175 reward for the winner.

- Giving out a $50 gift card after the completion of a health risk assessment questionnaire offered to all employees, even if they are not eligible for the company’s health plan.

Type 3: Health Plan-Related Activity-Only Programs

Type 3 programs are activity-only because, to receive a reward incentive, they require employees to complete a specific activity. As these programs only apply to individuals who are enrolled in their employer’s health plan, they are considered health plan-related. Also, many federal employees and benefits laws are applicable to these particular types of programs.

Type 4: Health Plan-Related Outcome-Based Programs

Type 4 programs will base their rewards on either the results of a test such as a biometric screening or the existence of a particular health condition. In this case, the reward requires participation in a health plan. As these programs require the employee to satisfy some health-related standard to receive the reward incentive, they are considered to be outcome-based, and they are health plan-related because only employees enrolled in the employer’s health plan can participate. Many additional federal employment and benefits laws apply to these types of programs. These programs will have the strictest rules of all the types of wellness programs.

Key Laws to Consider

As mentioned above, there are many federal regulations and employee and benefit laws that must be taken into account when creating a health and wellness incentive program and the rewards and incentives you may use for your company. Some of the key laws that should be taken into consideration when creating health and wellness incentive plans include:

- PPACA

- HIPAA Non-Discrimination

- HIPAA Privacy & Security

- ERISA

- COBRA

- ADEA

- ADA

- Title VII

- FLSA

- GINA

- Tax Laws

- Tax code non-discrimination

- Cafeteria Plan

We will briefly review these laws and regulations and some of the legal requirements that may be applicable to your company’s health and wellness incentive programs.

PPACA – Patient Protection and Affordable Care Act

The Patient Protection and Affordable Care Act is health care reform legislation that was signed into law in 2010 by President Barack Obama. When creating your company’s wellness program, it is important to consider how it will affect employees’ deductibles, copayments, coinsurance, or coverage for any of the services listed in the Summary of Benefits and Coverage (SBC). If it causes them to vary in any way, that treatment scenario’s calculations must make the assumption that the individual is participating in the wellness program and it will be necessary to include additional language in the SBC.

HIPAA – Health Insurance Portability and Accountability Act

Health Insurance Portability and Accountability Act was enacted in August of 1996. There are two main elements to consider in regards to HIPPA when creating your health and wellness program. Those two elements are Non-Discrimination and Privacy & Security.

Wellness programs are subject to the HIPAA nondiscrimination rules if they offer rewards related to a health plan that require the completion of a particular health-related action in order to receive the reward – this could include things like diet plans or exercise programs. The HIPAA nondiscrimination rules require group health plans to ensure that they do not discriminate in health coverage among individuals on the basis of a “health factor,” in terms of eligibility, benefits or costs. There are eight “health factors” that cannot be used in order to discriminate against individuals in providing them health coverage:

- Health status

- Medical conditions such as physical or mental illness

- Claims experience

- Receipt of health care

- Medical history

- Genetic information

- Disability

- Evidence of insurability

The second element of HIPPA that must be taken into consideration is Privacy & Security. With the exception of health programs such as small, self-insured group health plans, with less than 50 eligible individuals, which are established and maintained by the employer, many wellness programs will be subject to HIPAA’s Privacy and Security rules and regulations.

ERISA – Employee Retirement Income Security Act

1974’s Employee Retirement Income Security Act set minimum standards for the majority of private industry’s voluntarily established health and pension plans in order to provide protection for the employees in these plans. An employee welfare benefit plan under ERISA, will be required to satisfy ERISA’s applicable compliance requirements, which include the following:

(1) There has to be a plan document; (2) The plan terms have to be followed and strict fiduciary standards must be adhered to; (3) SPDs (SMMs and SMRs) must be provided to all the plan’s participants; (4) Form 5500 must be filed annually (subject to certain exceptions); and (5) Claims procedures have to be established and followed by all parties involved.

COBRA – Consolidated Omnibus Budget Reconciliation Act

The Consolidated Omnibus Budget Reconciliation Act of 1985 mandates insurance programs that provide continued health insurance coverage to employees after they have left their employment. Health plans are obligated to comply with any and all applicable COBRA requirements. Some of the most significant COBRA obligations are listed here:

(1) Provision of a General Notice: Every participant and the participant’s spouse must be provided with a General Notice when their coverage under the program starts; (2) Provision of an Election Notice: Every Qualified Beneficiary must be provided with an Election Notice which must contain a notice of the Qualified Beneficiaries rights and obligations for a specific qualifying event, such as reduction in employment hours, or termination of employment. It is worth noting that the Election Notice for the wellness program can be combined with the Election Notice for the employer’s major medical plan(s); (3) If applicable, there must be a provision of a Notice of Unavailability: If an individual is anticipating receiving a continuation of COBRA coverage, but are not actually entitled to receive such coverage, they must be provided with a Notice of Unavailability; (4) Coverage: if a Qualified Beneficiary under the wellness program elects COBRA continuation coverage, the beneficiary may generally receive coverage for a basic coverage period, which will be same period of time as in the case of any other COBRA continuation period. In addition, the Qualified Beneficiary would be entitled to any incentives that are available to active employees and would also be permitted to elect any other group health coverage that is offered to other employees during open enrollment period; and (5) If applicable, provision of an Early Termination Notice: If COBRA continuation is terminated before the end of the maximum coverage period, a Notice of Termination must be provided to the Qualified Beneficiary.

ADEA – Age Discrimination in Employment Act

The ADEA strictly prohibits employers from engaging in age-based discrimination against job applicants and employees with respect to benefits. To be protected under ADEA, individuals must be at least 40 years old. As a result, if a wellness program decreases wellness rewards, terminates, or in any other way discriminates against employees over 40, it could be found to be in violation of ADEA.

ADA – Americans with Disabilities Act

There are two areas of concern under the ADA with regard to wellness programs. First, the ADA prohibits employers from discriminating against individuals with disabilities. For example, a program that provides a reward based on a health condition may discriminate against individuals who have a disability. This may violate the ADA even if the program is designed so that it complies with the HIPAA nondiscrimination requirements. Second, the ADA limits when employers may make medical inquiries or conduct medical examinations.

Title VII of the Civil Rights Act

Title VII relates to the “terms, conditions, or privileges of employment,” which will generally include health and wellness programs. Therefore, the wellness program could be found in violation of Title VII if an employer discriminates or takes into account any plan participant’s race, religion, sex, color, or national original.

FLSA – Fair Labor Standards Act

The Fair Labor Standards Act established rules and regulations related to, among other things, overtime pay eligibility. Under the FLSA, any and all nonexempt employees must be compensated for time worked over 40 hours in any given workweek at a rate of not less than time and one-half of their regular pay. It is important to take this into account when crafting a wellness program because, if the time an employee spends completing a health and wellness program is considered “compensable time,” it is possible that the employer may have to pay overtime to the employee. If four conditions are met, it is not necessary to consider the time spent on health programs to be compensable time: (1) if program attendance is outside of the employee’s normal work hours; (2) if program attendance is completely voluntary; (3) if the lecture or class is not directly related to the employee’s job; and (4) if the employee is not doing any productive work during the lecture or class.

GINA – Genetic Information Nondiscrimination Act

The Genetic Information Nondiscrimination Act of 2008 prohibits employers from discriminating against any employee in regard to compensation, terms, conditions, or privileges of employment on the basis of “genetic information. General prohibitions include:

- Employers may not request, require or purchase genetic information.

- Employers must maintain genetic information as a confidential medical record.

- Strict limits must be applied to any disclosure of genetic information.

Tax Laws & Tax code

It is important to be aware of tax laws and codes because rewards that come in the form of cash, such as a cash bonus, or gift cards and other cash-equivalents are taxable. Rewards provided by employers to their employees, such as rewards cards, gift cards, or cash, will be considered taxable income and will be subject to employment taxes and wage withholding. For instance, if all employees who complete a health risk assessment are rewarded with a $25 gift card from their employer, all participating employees will have an additional $25 of their income that will be subject to wage withholding and employment taxes. Internal Revenue Code Section 132 qualifies rewards such as some employee discounts, mugs, clothing, and various other rewards as de minimis fringe benefits, for which employees will not own taxes. The de minimis standard does not apply to cash rewards. To better understand what qualifies as de minimis fringe benefits, it is important to refer to IRS Publication 15-B Employer’s Tax Guide to Fringe Benefits.

Cafeteria Plan

A Cafeteria Plan allows employees to pay health insurance premiums and certain other qualified expenses on a pre-tax basis, which will reduce their total taxable income. The Section 125 cafeteria plan regulations allow an employer to set up their cafeteria plan to change a qualified employee’s salary reduction to reflect their reduced premium, providing the decrease in premium is deemed to be “insignificant.” However, if the decrease in premium is deemed to be “significant,” an employee may choose to have their salary reduction changed in order to reflect the premium decrease. If an employee loses a wellness reward and is now required to pay a higher monthly premium, Section 125 regulations also allow mid-year changes. More information can be found on the effect of cost changes on permissible salary reduction changes, in the Treasury Regulation Section 1.125-4(f)(2).

In conclusion, any applicable laws must be navigated and taken into account when creating a health and wellness incentive program. When crafting a health and wellness rewards program, it is essential to consult with experts who are knowledgeable regarding both legal concerns and health and wellness program types and the reward incentive technology used to issue them. All Digital Rewards shares your commitment to your participant’s health and wellness and understands the concerns and requirements associated with establishing a quality health and wellness rewards program. With our Healthy Choice Rewards, Living Well Reward ™ card, and robust Health and Wellness point’s based platform technology all of which can be fully branded and personalized, you can quickly and effectively reward participants in your company’s health and wellness program. With our vast experience in offering rewards programs, we can tailor a program that will ideally fit your company’s specifications and meet all applicable legal requirements. Give our Health and Wellness Reward Program experts a call at 866-415-7703 or click the “Schedule a Demo” button below!