Introduction to Reward Cards and Incentive Cards

Did you know that the global market size for gift cards, which includes prepaid rewards and incentive cards, is expected to reach $750 billion by 2026? That’s a staggering figure and a testament to the role these cards play in today’s business landscape. If you’ve ever wondered about how difficult it would be to implement a rewards or incentives program within your organization, you’re certainly not alone. One of the most common yet perplexing decisions revolves around Reward Prepaid Cards vs Incentive Prepaid Cards and which one to choose. Does it make a significant difference? The answer is a resounding yes.

Understanding the differences between these two types of prepaid cards is crucial for the success of your program. This guide aims to demystify these categories, providing you with a comprehensive understanding that can help inform your strategic decisions. By the time you finish reading, you’ll be well-equipped to navigate this often complex landscape with confidence.

Shall we begin?

Prepaid Card Definitions

Before we explore deeper, it’s essential to understand some key definitions. Are these terms just buzzwords, or do they carry significant weight? Let’s find out the differences of Reward Prepaid Cards vs Incentive Prepaid Cards.

Reward Prepaid Cards: These are designed to acknowledge past actions or accomplishments. Think of them as a ‘thank you’ note in monetary form. Reward cards are generally issued after a specific behavior or milestone has been achieved.

Incentive Prepaid Cards: Contrarily, these are all about the future. Their primary function is to motivate specific actions or behaviors. Incentive cards are often part of a structured program, driving individuals to meet predefined objectives.

Digesting these definitions yet? Keep them in mind as they’ll be the cornerstone for everything we discuss going forward.

Key Objectives of Prepaid Reward and Incentive Cards

Now that we’ve laid down the basic definitions, let’s dig a bit deeper, shall we? The objectives behind using Reward and Incentive Prepaid Cards are fundamentally different, and understanding this difference is key to the success of your program.

Reward Cards: Acknowledge Past Behaviors

Reward Prepaid Cards serve as a retrospective acknowledgment. Imagine you have an employee who has just knocked a big project out of the park or a customer who has been loyal to your brand for years. How do you say ‘thank you’ in a way that’s both meaningful and impactful? Reward cards are your answer. They are generally issued after the desired action has been completed and serve to reinforce positive behavior.

Examples: Employee of the Quarter awards, anniversary gifts, and customer retention programs.

Incentive Cards: Encourage Future Behaviors

Incentive Prepaid Cards, on the other hand, have their eyes on the future. Picture this: you’re rolling out a new product or service and need to drive user adoption. Or perhaps, you want your employees to participate in a new wellness program. Incentive cards are the proverbial carrot on a stick. They are usually issued as part of a more structured program with clearly defined goals and metrics.

Examples: Sign-up bonuses for new services, participation incentives for surveys, and performance milestones.

By now, you might be asking yourself, “Which type of card aligns best with my organizational objectives?” It’s a crucial question and one that this guide aims to help you answer. Remember, the objective is not just what you aim to achieve; it’s also about how you aim to achieve it.

Prepaid Card Issuance Conditions

Understanding when and how to issue these cards is equally important as knowing why you’re using them in the first place. The issuance conditions for Reward vs Incentive Prepaid Cards can dramatically affect the efficacy of your program. Let’s dissect these conditions:

Reward Cards: Post-Behavior Issuance

With Reward Prepaid Cards, issuance is straightforward but timing-sensitive. These cards are typically handed out after the qualifying action or behavior has taken place. For example, let’s say your sales team has just closed a significant deal. A Reward Prepaid Card could be issued immediately after to celebrate and acknowledge their hard work.

Incentive Cards: Structured Programs, Pre-Defined Objectives

On the flip side, Incentive Prepaid Cards often require a more complex issuance framework. These cards usually come as part of a broader, structured program where participants earn the card by meeting specific milestones or objectives. Consider a customer loyalty program where points are accumulated over time. Once a customer reaches a certain point threshold, an Incentive Card is issued.

Are you starting to see how the issuance conditions can make or break your program? It’s not just about ‘what’ you’re offering but also ‘when’ and ‘how’ you deliver it. The nuances in issuance conditions can significantly influence how well your cards achieve their intended objectives.

Flexibility and Branding For Reward and Incentive Cards

So, how flexible are these cards, and what’s the deal with branding? Let’s break down the key differences between Reward vs Incentive Prepaid Cards.

Flexibility in Reward Cards

Reward Prepaid Cards often offer a higher degree of flexibility when it comes to where they can be used. Whether it’s online shopping or a meal at a fancy restaurant, the recipient usually has a wide array of choices.

Branding in Incentive Cards

Incentive Prepaid Cards, on the other hand, are more likely to carry branding elements, such as a company logo or promotional material. Why? Because they serve a dual purpose: to incentivize and to engage. Branding helps maintain an ongoing relationship with the recipient.

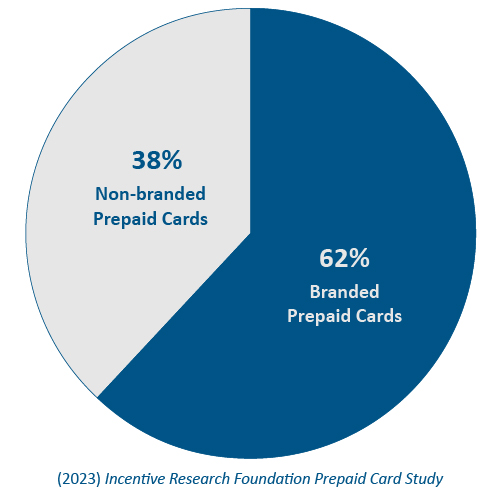

Enhanced brand recognition and reinforcement with branded prepaid cards.

Understanding the flexibility and branding options for each card type can help you tailor your program to meet specific organizational objectives. Are you aiming for broad appeal or targeted engagement? The answer could influence your choice between Reward and Incentive Cards.

Tax Implications Issuing Prepaid Reward and Incentive Cards

Ah, taxes, the inevitable fine print that we can’t afford to ignore. Have you considered the tax implications of issuing Reward vs Incentive Prepaid Cards?

Reward Cards: Usually Considered Taxable

Most jurisdictions view Reward Prepaid Cards as taxable income. This means both you and the recipient may have tax obligations.

Incentive Cards: Varied Tax Implications

The tax landscape for Incentive Cards can be a bit more complex, often depending on the structure of the incentive program.

Navigating the financial differences between reward and incentive prepaid cards requires a thorough understanding of the potential tax implications. When you gift cards, there are scenarios where tax obligations may not arise, which can be quite advantageous. Here are some key points to consider:

- De Minimis Fringe Benefits:

- Reward Prepaid Cards: Often given to employees or customers for achievements or loyalty, these might fall under de minimis fringe benefits if the value is low and the gifting is infrequent.

- Incentive Prepaid Cards: These might also be considered de minimis fringe benefits, especially if they’re part of a broader incentive program aimed at spurring desired behaviors or performance.

- Annual Gift Tax Exclusions:

- Both Reward and Incentive Prepaid Cards might be subject to annual gift tax exclusions if they’re given personally or within a familial context. The tax exemption threshold would apply to the total value of gifts given in a year, including these cards.

- Employee Recognition Awards:

- Reward Prepaid Cards: Often used as recognition awards for employees, these cards might be exempt from tax up to a certain value or under specific conditions based on local tax laws.

- Incentive Prepaid Cards: Similarly, these cards used as part of an employee incentive program might enjoy tax exemptions under certain conditions.

- Charitable Contributions:

- If either Reward or Incentive Prepaid Cards are donated to charitable organizations, they may not have tax implications for the donor, and might even be tax-deductible.

- Educational or Medical Exclusions:

- These exclusions might not directly relate to the typical use cases of Reward or Incentive Prepaid Cards unless they are being donated for educational or medical purposes.

Navigating tax regulations is crucial for both compliance and budgeting. It’s a detail that, if overlooked, could bring unintended complications to your program.

Common Prepaid Card Use Cases – Reward Prepaid Cards vs Incentive Prepaid Cards

Understanding the practical applications of Reward and Incentive Prepaid Cards can offer you valuable insights into which card type best suits your organizational needs. Let’s examine some common use cases for each:

Reward Prepaid Cards

- Employee Recognition: Company XYZ issued reward prepaid cards to their top-performing employees last quarter, resulting in a 20% increase in employee satisfaction scores. (Source: Incentive Research Foundation 2023 Prepaid Card Study)

- Customer Retention: Company XYZ is a leading retailer of electronics. The company offers a loyalty program called “XYZ Rewards” that rewards customers with points for every purchase they make. Customers can then redeem these points for reward prepaid cards, which can be used at any participating merchant. (Source: Customer Loyalty Programs and Customer Retention: A Meta-Analysis)

- Sales Incentives: Company DEF offers a sales incentive program that rewards sales representatives with reward prepaid cards for achieving or exceeding their sales targets. This program has helped Company DEF to increase sales by 15% year-over-year. (Source: The Sales Management Association 2023 Sales Incentive Trends Report)

- Event Participation: Company GHI invited speakers, panelists, and attendees to their annual industry conference. As a thank-you for their participation, Company GHI gave each guest a reward prepaid card that could be used at any participating restaurant or store in the city. This gesture was well-received by guests, and many of them have said that they plan to attend the conference again next year. (Source: Event Marketing Association 2023 Event Marketing Trends Report)

- Market Research: Company HIJ conducts focus groups and surveys with customers to gather feedback on their products and services. As a token of appreciation for their time and insights, Company HIJ gives participants a reward prepaid card. This incentive helps Company HIJ to attract a large number of participants to their research studies. (Source: Market Research Association 2023 Market Research Trends Report)

- Referral Programs: Company IJK offers a referral program that rewards customers for referring new business leads to the company. When a customer refers to a new lead who makes a purchase, the referring customer receives a reward prepaid card. This program has helped Company IJK to increase its customer base by 25% year-over-year. (Source: Referral Marketing Association 2023 Referral Marketing Trends Report)

Incentive Prepaid Cards

- New Customer Onboarding: Company KLM offers a sign-up bonus to new customers who open an account and make a deposit. The sign-up bonus is in the form of an incentive prepaid card, which can be used to make purchases at any participating merchant. This incentive has helped Company KLM to attract over 100,000 new customers in the past year. (Source: Incentive Research Foundation 2023 Prepaid Card Study)

- Employee Wellness Programs: Company MNO offers an employee wellness program that rewards employees for participating in healthy activities, such as going to the gym, eating healthy meals, and getting regular preventive care checkups. Employees who participate in the program earn points, which can be redeemed for incentive prepaid cards. This program has helped Company MNO to reduce employee healthcare costs by 10%. (Source: Centers for Disease Control and Prevention 2023 Employee Wellness Programs Report)

- Survey Participation: Company OPQ conducts monthly surveys with customers and employees to gather feedback on their products, services, and workplace environment. As an incentive to complete the surveys, Company OPQ offers respondents a chance to win an incentive prepaid card. This incentive has helped Company OPQ to increase survey response rates by 20%. (Source: SurveyMonkey 2023 Survey Trends Report)

- Product Launches: Company QRST is launching a new product line. To encourage customers to try the new products, Company QRST is offering a free incentive prepaid card with every purchase of a new product. This incentive has helped Company QRST to generate over $1 million in sales of the new product line in its first month. (Source: Incentive Research Foundation 2023 Prepaid Card Study)

- Skill Development: Company STU offers an employee training and development program. Employees who complete training courses and earn certifications are rewarded with incentive prepaid cards. This incentive has helped Company STU to increase employee training participation rates by 50%. (Source: Association for Talent Development 2023 Talent Development Trends Report)

- Loyalty Programs: Company XYZ is a leading retailer of clothing and accessories. The company offers a loyalty program called “XYZ Rewards” that rewards customers for reaching specific spend thresholds or for frequent purchases. Customers who participate in the program earn points, which can be redeemed for exclusive discounts on merchandise or early access to new products.

- Company XYZ has found that its loyalty program has been very effective in retaining customers. In fact, the company has a customer retention rate of over 95%. (Source: Customer Loyalty Programs and Customer Retention: A Meta-Analysis)

- So, which card type aligns best with your current initiatives? Do you need to acknowledge effort and success that’s already occurred, or are you looking to drive future action and engagement? The right card can make all the difference. Selecting the appropriate use cases can help you design a more effective and engaging rewards or incentives program.

FAQ Prepaid Cards

Got questions? You’re likely not alone. Here are some of the most frequently asked questions when it comes to Reward and Incentive Prepaid Cards.

Create stylish call-to-action buttons with Qubely Buttons. Play around with typography, design, border and more. Add animations and personalize it to engage visitors instantly.

These FAQs should address some of your immediate queries, but remember, each program is unique, and it’s crucial to consult professionals for tailored advice.

Wrapping up the Differences: Conclusion

By now, you should have a comprehensive understanding of the differences between Reward vs Incentive Prepaid Cards. It’s not just a matter of semantics; the choice between these two can significantly impact the effectiveness of your organizational programs. Whether you’re looking to acknowledge past achievements or drive future behavior, selecting the right card type is pivotal. Below is a table to use for a quick reference to understand the key difference between reward cards and incentive cards.

| Prepaid Card Features | Reward Cards | Incentive Cards |

|---|---|---|

| Objective | Acknowledge past actions or behaviors | Drive a specific future action or behavior |

| Issuance Conditions | Typically issued unconditionally | Issued based on predefined objectives |

| Branding | Flexible in terms of branding | More tightly branded |

| Tax Implications | Vary based on jurisdiction and usage | Vary based on jurisdiction and usage |

| Use Cases | Employee of the Month, Customer Loyalty, etc. | New Customer Acquisition, Sales Incentives, Wellness, etc. |

| Flexibility in Usage | Broad usage possibilities | May be tied to specific retailers or categories |

| Reward & Incentive Card Use Cases | Employee Recognition: Awarding top-performing employees during quarterly or annual reviews. | New Customer Onboarding: Offering cards as a sign-up bonus for new services or subscriptions. |

| Customer Retention: Offering cards as a ‘thank you’ to long-term customers, thereby encouraging continued business. | Employee Wellness Programs: Encouraging employees to take part in health and wellness activities. | |

| Sales Incentives: Rewarding sales teams for achieving or exceeding targets within a specific period. | Survey Participation: Incentivizing customers or employees to provide feedback through surveys. | |

| Event Participation: Thanking speakers, panelists, or attendees after participating in a company event. | Product Launches: Encouraging trial and adoption of a new product or feature. | |

| Market Research: Compensating participants in focus groups or surveys that provide valuable market insights. | Skill Development: Incentivizing employees to complete training or certification programs. | |

| Referral Programs: Encouraging current customers or employees to refer new business leads. | Loyalty Programs: Rewarding customers for reaching specific spending thresholds or for frequent purchases. |

Have you identified which card aligns best with your current initiatives? Your decision can be the foundation for creating a successful, engaging, and compliant program. Ready to take the next step in optimizing your rewards or incentives program? Contact our team of experts today for a personalized consultation that can help you make the most informed choices.

Additional Resources

For further reading and insights, consider the following resources:

- Industry Reports: Gain data-driven insights into trends and best practices.

- Webinars and Workshops: Engage with experts in the field to deepen your understanding.

- Legal Guidelines: Familiarize yourself with the legal landscape surrounding prepaid cards to ensure compliance.

- Consultation Services: Sometimes, personalized advice can make all the difference. Consider consulting with professionals specialized in rewards and incentives.

We hope this guide serves as a valuable resource in your journey toward implementing a successful rewards or incentives program.