Why Corporate Incentives Are Evolving

The way we reward people in the workplace is changing—fast.

Once upon a time, corporate incentives were reserved for top-performing sales reps or high-level executives. But in 2025, the landscape looks very different. Companies are expanding the scope of incentives to include customer service teams, remote workers, gig contributors, contractors, and even customers—because everyone contributes to growth, not just the sales team.

Why the shift?

Because engagement is now a business strategy—not just an HR buzzword. And rewards are one of the fastest, most effective ways to boost engagement, reinforce behaviors, and show appreciation.

But here’s the catch: today’s rewards need to be scalable, easy to deploy, and flexible enough to meet the needs of diverse workforces. That’s where corporate gift card solutions come in. They’re not just convenient—they’re transformational.

If you’re still manually managing incentive programs or relying on outdated reward catalogs, this guide is for you. Let’s explore how corporate gift cards have evolved into a strategic asset for modern organizations.

IRF Trend – Companies Expanding Rewards Beyond Sales

According to the Incentive Research Foundation’s 2025 Trends Report, companies are doubling down on rewards—but not just for their sales teams.

The data shows that a growing number of organizations are incentivizing non-sales roles like operations, logistics, customer service, IT, and even finance. They’ve realized that these roles play a direct, measurable part in customer satisfaction, retention, and internal efficiency.

In short: everyone is part of the revenue engine now.

But when you widen your incentive net, you run into some new challenges: How do you make rewards relevant to different departments? How do you avoid administrative overload? And how do you stay compliant while scaling?

The IRF’s findings are clear: flexible, non-cash rewards—especially digital gift cards—are becoming the go-to solution. They’re easy to personalize, deliver quickly, and align well with compliance requirements and diverse role types.

If you’ve been wondering how to go beyond SPIFFs and stretch your incentive impact across the entire organization, this is your signal: it’s time to scale smarter.

Where Gift Cards Outperform – Engagement, Control, Compliance

Let’s face it—building an effective incentive program is hard. You want something that drives motivation, but doesn’t balloon your budget. You want something that feels personal, but doesn’t take your admin team three weeks to set up. And, of course, it has to pass legal and compliance review.

Gift cards hit the sweet spot.

Here’s why they’re outperforming traditional incentive models:

💡 1. Engagement that Feels Personal

Unlike generic merch or points that collect dust, gift cards offer instant gratification and real-world value. Employees or customers can pick something they truly want—from a coffee on Monday morning to a big-ticket Amazon buy.

🔐 2. Built-in Control

With the right platform, you can control delivery timing, expiration, value, and redemption options—down to individual users. You set the rules. No more open-ended budget surprises.

🧾 3. Compliance Made Easy

Whether you’re navigating IRS thresholds, GDPR/CCPA data rules, or HIPAA safeguards for wellness rewards, modern gift card platforms (like ADRs) have built-in trackability and audit trails.

Gift cards aren’t just convenient—they’re strategic. They eliminate guesswork, reduce friction, and make incentives easier to manage at scale.

IRF Trend – Companies Expanding Rewards Beyond Sales

According to the Incentive Research Foundation’s 2025 Trends Report, companies are doubling down on rewards—but not just for their sales teams.

The data shows a growing number of organizations are incentivizing non-sales roles like operations, logistics, customer service, IT, and even finance. Why? Because they’ve realized these roles play a direct, measurable part in customer satisfaction, retention, and internal efficiency.

In short: everyone is part of the revenue engine now.

But when you widen your incentive net, you encounter new challenges: How do you make rewards relevant to different departments? How do you avoid administrative overload? And how do you stay compliant while scaling?

The IRF’s findings are clear: flexible, non-cash rewards—especially digital gift cards—are becoming the go-to solution. They’re easy to personalize, deliver quickly, and align well with compliance requirements and diverse role types.

If you’ve been wondering how to go beyond SPIFFs and stretch your incentive impact across the entire organization, this is your signal: it’s time to scale smarter.

Where Gift Cards Outperform – Engagement, Control, Compliance

Let’s face it—building an effective incentive program is hard. You want something that drives motivation, but doesn’t balloon your budget. You want something that feels personal, but doesn’t take your admin team three weeks to set up. And, of course, it has to pass legal and compliance review.

Gift cards hit the sweet spot.

Here’s why they’re outperforming traditional incentive models:

💡 1. Engagement that Feels Personal

Unlike generic merch or points that collect dust, gift cards offer instant gratification and real-world value. Employees or customers can pick something they truly want—from a coffee on Monday morning to a big-ticket Amazon buy.

🔐 2. Built-in Control

With the right platform, you can control delivery timing, expiration, value, and redemption options—down to individual users. You set the rules. No more open-ended budget surprises.

🧾 3. Compliance Made Easy

Whether you’re navigating IRS thresholds, GDPR/CCPA data rules, or HIPAA safeguards for wellness rewards, modern gift card platforms (like ADRs) have built-in trackability and audit trails.

Gift cards aren’t just convenient—they’re strategic. They eliminate guesswork, reduce friction, and make incentives easier to manage at scale.

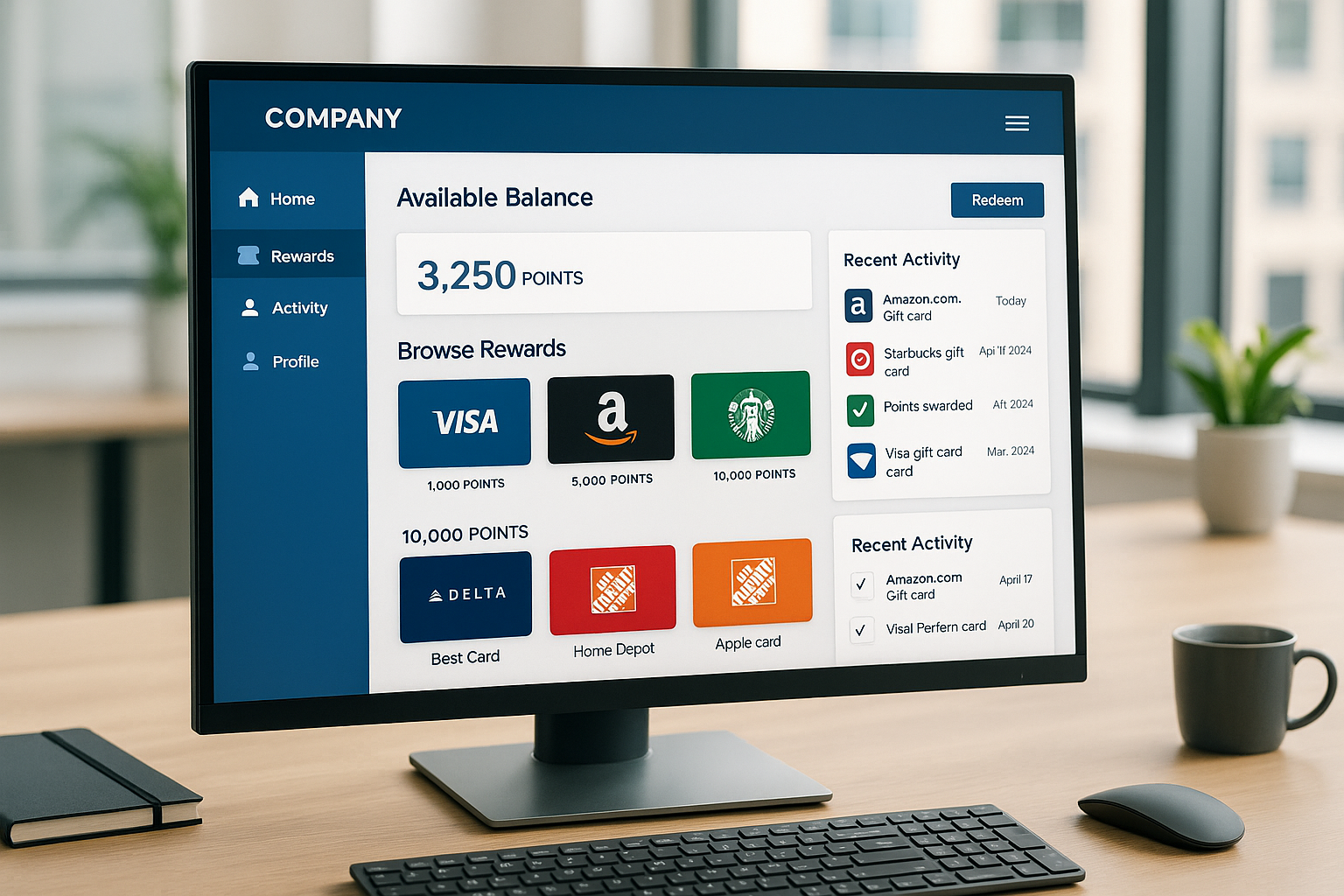

Customization and White-Label Options

Here’s something most companies underestimate: the reward experience is part of your brand experience.

When someone receives a reward—whether it’s a thank-you for completing onboarding, hitting a sales milestone, or filling out a feedback survey—it reflects on your organization. That’s why customization matters more than ever.

Modern corporate gift card platforms offer a suite of white-label features that let you tailor the look, feel, and delivery of your rewards. You can:

- Use your logo and brand colors on reward emails and landing pages

- Add personalized messages based on campaign type

- Offer curated gift card catalogs tailored to your audience

- Create multilingual, multi-currency experiences for global teams

Whether you’re rewarding employees or external partners, a branded gift card experience reinforces your values and adds a premium feel—even if you’re just sending a $10 card.

And when you combine this with automation or API triggers? You’re not just giving out rewards—you’re building a consistent, branded recognition ecosystem that people remember and appreciate.

When to Choose Prepaid vs. Merchant-Specific Gift Cards

Not all gift cards are created equal—and choosing the right type can make or break your program’s success.

Here’s a quick breakdown:

💳 Prepaid Cards (Visa/Mastercard)

These behave like cash and are the most flexible option. Recipients can use them anywhere the card is accepted—online or in-store. Prepaid is ideal when:

- You don’t want to limit choices

- You have a diverse or global audience

- You’re running a high-value incentive like a SPIFF or tiered reward

Prepaid cards are also great for B2B partner incentives, wellness reimbursements, and milestone bonuses where the recipient values freedom of choice.

Merchant-Specific Gift Cards

These are tied to specific retailers—think Amazon, Starbucks, Target, or Uber. They’re best when:

- You know your audience’s preferences

- You want to align the reward with your company culture (e.g., fitness brands offering Lululemon)

- You’re using small-denomination cards for micro-rewards

Merchant cards are typically lower cost to issue and can sometimes offer volume discounts or brand partnership perks.

🔄 Pro Tip: Many companies offer both—allowing recipients to choose. ADR’s platform, for example, lets you offer a curated marketplace experience where users pick the card that’s right for them.

The right choice depends on the audience, budget, and purpose. But either way, you’re giving something people want.

Budgeting for Scale – Tiers, Global Reach, Usage Data

Scaling your incentive program sounds exciting—until the finance team starts asking questions.

“How do we set limits by team?”

“What happens if someone doesn’t redeem their gift card?”

“Can we see ROI beyond just a redemption rate?”

Here’s the good news: gift card solutions are built to scale without creating financial chaos.

With a platform like ADR’s, you can:

- Segment budgets by department, region, or campaign

- Set approval rules, expiration dates, and caps on frequency

- Generate on-demand reports that break down reward activity by audience or goal

- Track redemptions and non-use so you only pay when cards are claimed (in many cases)

And if you’re global? ADR supports multi-currency and multilingual delivery, so your recognition program works whether your employees are in New York, Nairobi, or New Delhi.

You can also build tiered reward structures—like $10 for completing onboarding, $25 for referrals, $100 for milestone achievements—without creating separate workflows.

Smart scaling is all about balancing automation with oversight. Corporate gift card solutions let you do both—so you can reward generously without losing financial control.

Procurement Checklist for Choosing a Vendor

Ready to implement a gift card solution but not sure where to start?

Here’s a quick checklist to guide your evaluation:

✅ Reward Variety – Does the provider offer both prepaid and merchant-specific cards?

✅ Global Support – Can you send rewards internationally with currency and language localization?

✅ White-Labeling – Are there email, portals, and user experience branding options?

✅ Security & Compliance – Is the platform PCI DSS compliant? GDPR/CCPA/HIPAA ready?

✅ API & Automation – Can it integrate with your CRM, HRIS, or workflow tools?

✅ Reporting & Controls – Will you get granular visibility into usage, budget tracking, and redemptions?

✅ Customer Support – Do they offer onboarding, training, and responsive support?

✅ Pricing Transparency – Are fees clear (and fair), especially for unused or expired cards?

Use this list to compare vendors side-by-side and avoid hidden costs, tech limitations, or clunky experiences.

Support you can depend on

When you’re ready, ADR’s team can walk you through every item and tailor a solution that fits.

Gift cards are no longer just holiday handouts or sales team perks—they’re the backbone of modern incentive strategies. Scalable, flexible, and appreciated across every team, they help companies recognize great work, deepen engagement, and drive performance with less overhead and more impact.

Whether you manage 50 rewards a month or 5,000, a smart corporate gift card solution gives you control, branding, and results.

From API-powered automation to white-label customization and compliance-ready reporting, ADR delivers everything you need to build a program that works—and grows—with you.

Let’s build something better. Book a demo or request pricing today and see how we help businesses like yours reward smarter.