A Sales Performance Incentive Funds (SPIFF) program can be an incredibly effective way to drive revenue and engage your sales team—if it’s managed within a well-thought-out budget. While a strong SPIFF plan will deliver a solid return on investment (ROI), a poorly budgeted program risks overspending and underperforming.

In this blog, we’ll guide you through the core principles of SPIFF budgeting and show you how to maximize ROI. We’ll break down cost components, demonstrate ROI calculation methods, and offer practical tips for keeping expenses in check. For a comprehensive overview of creating a SPIFF plan that aligns with your organization’s objectives, check out “How to Create a High-Impact SPIFF Program for Your Sales Team”.

Understand the Core Cost Components

Before you determine how much to allocate for your SPIFF, it’s important to identify the main cost drivers:

- Rewards: Cash payouts, gift cards, prepaid debit cards, or experiential prizes.

- Technology & Tools: CRM integration, incentive management software, leaderboards.

- Marketing & Communication: Emails, promotional materials, or internal events.

- Administrative Overhead: Time and resources spent by HR, finance, or sales ops to manage the SPIFF.

Tip: Create a clear line item for each of these categories in your budget to avoid surprises later on.

Setting a Realistic Budget

Base It on Potential Revenue Lift

The essential question is: How much additional revenue or profit do you expect the SPIFF to generate? Use historical sales data, market trends, and your sales team’s previous performance to estimate an achievable lift.

- Example: If you project that your SPIFF will drive an additional $50,000 in revenue and your average profit margin is 30%, you can anticipate an extra $15,000 in profit. Allocating a portion of that, say $5,000, for incentives might be reasonable.

Factor in Participation Rates

Not everyone in your sales force may go full throttle, especially if your SPIFF is optional. Estimate what percentage of your team will fully engage. This helps ensure you don’t underspend or overspend on reward fulfillment.

ROI Calculation Methods

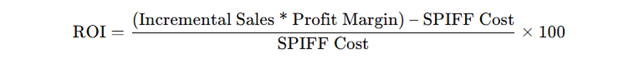

Simple ROI Formula

A straightforward method is:

- Incremental Sales: Extra revenue your program generates.

- Profit Margin: Use an average margin for all sales or margin specific to the product in question.

SPIFF Cost: Total expenditures, including rewards and administrative overhead.

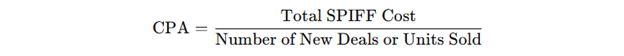

Cost-per-Acquisition (CPA) Analysis

Rather than looking at overall ROI, you might want to measure cost per acquisition:

- Lower CPA: Indicates better program efficiency.

Bonus Tip: If you’re running multiple incentive campaigns simultaneously, segment your analytics to track which SPIFF yields the highest ROI or lowest CPA. Check out “Using Analytics to Optimize SPIFF Program Performance” for more details.

Controlling Costs Without Losing Impact

Tiered Rewards

Instead of offering a flat reward for each sale, implement tiered incentives that encourage higher sales volume without committing to a massive budget from the outset.

- Example: $25 for every 5 units sold, an additional $50 once they hit 15 units, etc.

Group or Team Goals

Team-based SPIFFs can distribute reward costs across multiple participants while still fostering healthy competition. This often reduces per-person expense but still drives collaboration and collective performance boosts.

Non-Monetary Rewards

Sometimes, recognition or perks (e.g., an extra day off, a prime parking spot, or lunch with senior leadership) can be just as motivating as money—but cost far less. For more creative ways to energize your team, see “Top Mistakes to Avoid When Designing SPIFF Incentives” to learn what not to do.

Tracking and Reporting to Justify Budget

Weekly or Bi-Weekly Updates

Set up recurring reports to track how the SPIFF is performing against your projected budget. Seeing real-time or near-real-time numbers helps you identify overspending early or reallocate funds if some elements are underutilized.

Reward Disbursement

Stay on top of reward fulfillment:

- Instant Payouts: Helps maintain momentum and keeps morale high.

- Budget Checkpoints: If you’re nearing your allocated amount faster than expected, consider whether you need to adjust the SPIFF or accept the extra cost.

Case in Point: If your sales team is exceeding goals, you may be spending more on rewards than planned—yet the program could be delivering a significantly higher ROI. This is a good problem to have, but it still needs to be tracked and managed.

Real-World Budgeting Example

Let’s illustrate how budgeting might work in practice.

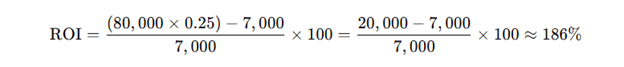

- Goal: Increase sales of a specific product line by 15% in one quarter.

- Forecasted Lift: $80,000 in new revenue.

- Profit Margin: 25% (so $20,000 in profit from new sales).

- Planned SPIFF Budget: $7,000 total.

- Rewards: $5,000

- Software & Administration: $2,000

Projected ROI:

That’s a solid return, assuming performance meets expectations. The key is to monitor actuals vs. forecasts and adjust promptly if the SPIFF either underperforms or overshoots targets.

Post-Program Analysis

Once the SPIFF concludes, measure your final ROI and compare it against your initial forecasts:

- Revisit Each Cost Line Item: Did rewards cost more or less than expected? Did software or administrative fees increase?

- Assess Incremental Sales: Did you meet, exceed, or fall short of your revenue projection?

- Gather Feedback: Survey participants for insights—were the rewards motivating? Did they feel the budget was fair?

These insights not only help you validate your initial budgeting assumptions but also improve your processes for the next SPIFF initiative.

Conclusion

Budgeting for a SPIFF program is as much about strategy and foresight as it is about dollars and cents. By understanding core cost drivers, setting a realistic budget tied to expected performance, and closely monitoring ROI, you’ll be well-positioned to launch incentives that truly drive sales without breaking the bank.

For a holistic view of how to build, run, and evaluate a successful SPIFF initiative, visit “The Ultimate Guide to SPIFF Programs: Boosting Sales Performance”.